Which of the Following Definitions Best Describes Targeting Inflation

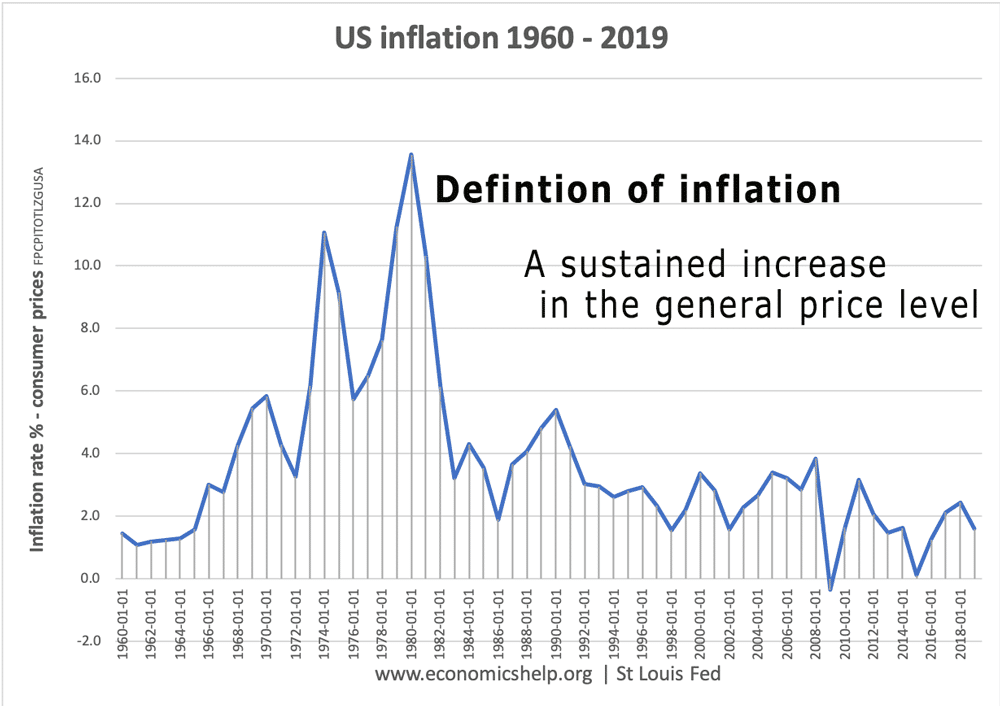

A result of demand-pull inflation is an increase in consumer prices because there isnt. O It can occur even when many goods are falling in price.

What To Aim For The Choice Of An Inflation Objective When Openness Matters

Which Of The Following Best Describes Hyperinflation.

. Question 14 8 pts Which of the following does NOT describe inflation. The fluctuation in revenue and expenditures caused by Congress and the president d. Which of the following definitions best describes the federal funds rate.

Decreases the amount of money in the financial system. Demand-output inflation price pressure inflation and the process of building in inflation. It follows a strict Taylor rule c.

The cost push inflation rate increases as inputs to production increase at a rapid rate. It follows strict inflation targeting b. Both A and B.

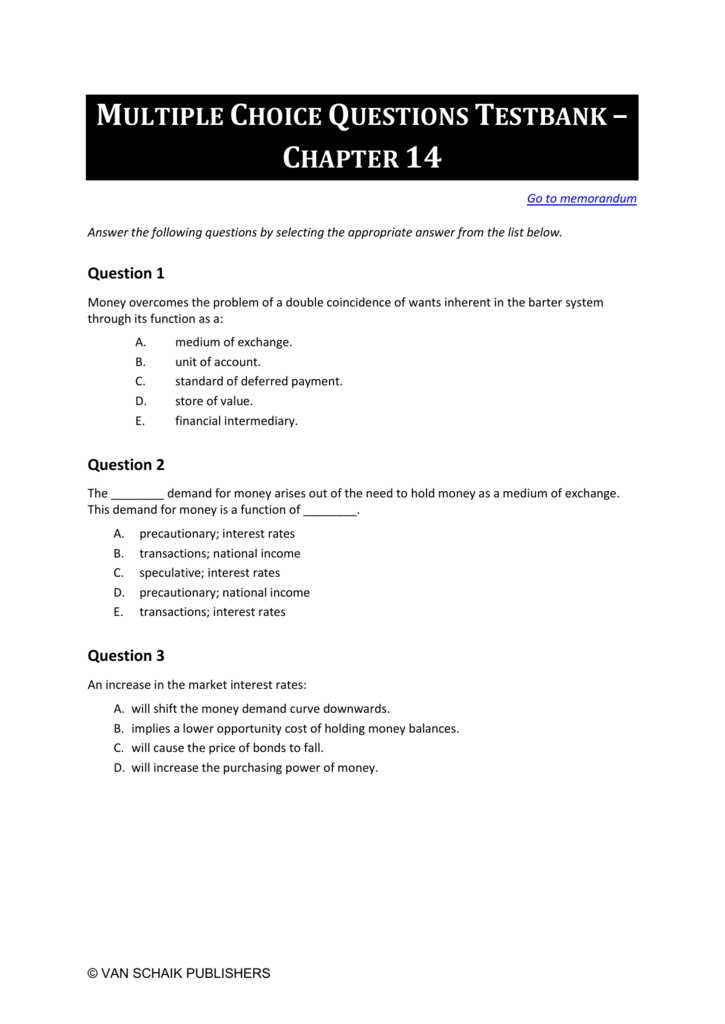

Which of the following best describes the policy of the Fed. Does inflation targeting help reduce the time-inconsistency of discretionary policy. Which of the following BEST fits the definition of inflation.

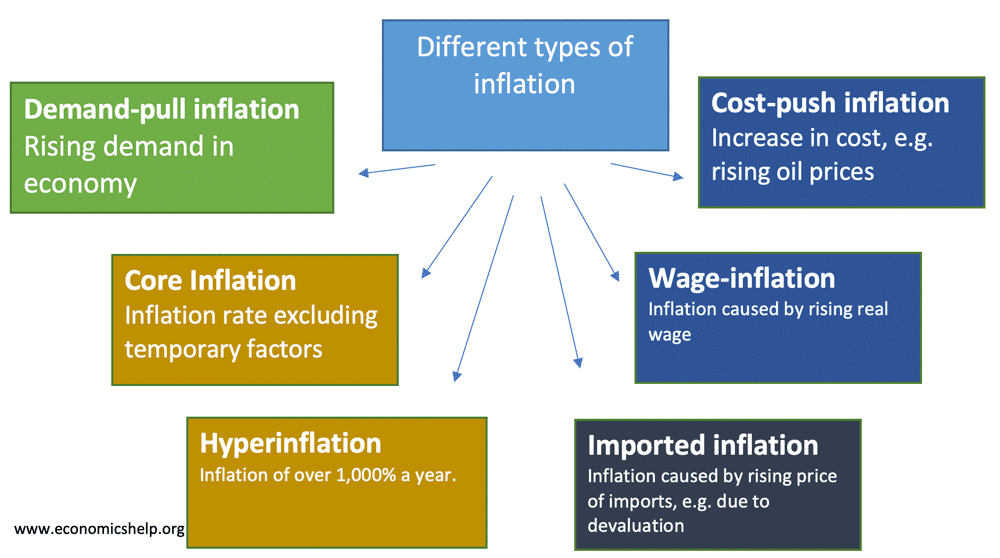

The increase in the price of goods and services that an economy generates is considered to be hyperinflation. Hyperinflation usually occurring over half a percent a month differs slightly from inflation which is a measure of increasing inflation for goods and services. What monetary policy tools does the Fed use to ensure Americans are.

The interest that banks charge other banks on an overnight loan to cover their reserve requirements. Suppose there are 325 million working-age adults and 295 million in the. A general and ongoing fall in the level of prices in an entire economy.

Which of the following best defines inflation. Flexible inflation targeting is best described as A. The central bank does this to make you believe prices will continue rising.

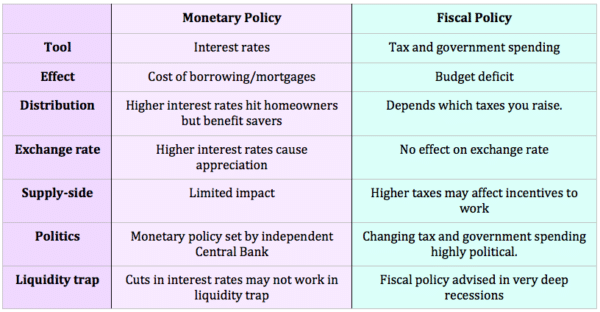

The price of most goods and services increases by 5 and over a 2 year period Which of the following BEST describes the effect inflation has on purchasing power in the United States over the past several decades. The central bank does this to make you believe prices will continue rising. Inflation targeting is a type of monetary policy that aims to achieve and sustain a set interest rate over a period.

Which of the following definitions best describes targeting inflation. Increasing the federal funds rate by the Fed. Allowing short-run deviations in inflation from target to better promote output stability.

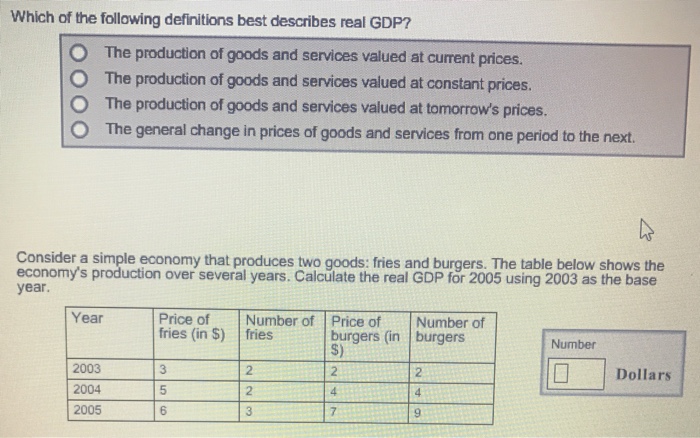

Which of the following definitions best describes targeting inflation. A monetary policy rule that describes the setting of federal funds rate target under Chairman Greenspan and Bernanke. The CPI can be found in any year by dividing the cost of the market basket by the cost of the same market basket in its given year which is all y year divide the cost of the market basket in year t by the cost of the same market basket in the base year CPI in 1984 7575 x 100 The CPI is only an index value and its value of 100 in.

Using the Federal Reserve s best judgment in conducting monetary policy to control inflation. The interest that banks charge other banks on an overnight loan to cover their reserve requirements. A change in relative prices.

Select the correct answer below. An intermediate target which is rarely used by central banks. Using the Feds best judgment in conducting monetary policy to control inflation.

A general sustained upward movement of prices for goods and services in an economy c. The monetary policy strategy employed by the Federal Reserve. Inflation targeting is a central banking policy that revolves around meeting preset publicly-displayed targets for the annual rate of inflation.

To control the inflation rate set specific goals. Using the Federal Reserves best judgment in conducting monetary policy to control inflation. Increasing the federal funds rate by the Fed.

This statistic measures on a rolling twelve-month basis change in. Setting explicit goals to control the inflation rate. Which of the following is an advantage of inflation targeting.

How a Wage-Price Spiral Begins A wage-price spiral is. Among the following definitions which ctant describes targeting inflation. O It is an increase in the cost of a given basket of goods.

Price inflation occurs as a result of three main factors. Economics questions and answers. Which of the following definitions best describes targeting inflation.

Inflation targeting is a monetary policy where the central bank sets a specific inflation rate as its goal. To regulate inflation which of the following tasks should FED performed. It follows a monetarist policy rule d.

A general and ongoing rise in the level of prices in an entire economy. O It reduces the real value of anything expressed in dollars. It places a great importance on the rate of inflation but without following strict inflation targeting.

A Federal Reserve increase in the federal funds rate. Whenever a rise in input prices such as labor or raw materials occurs inflationary pressure is triggered. Changing the desired inflation target as economic conditions change.

How Is Cpi Inflation Calculated. The rapid increase in the price of a specific good such as gasoline b. O It means that the price of every good and service is rising.

Thus there is a reduction in the supply of goods as a result. 1Which of the following best defines inflation.

Definition Of Inflation Economics Help

The Case Of Brazil On Manifold At The Becker Friedman Institute For Economics

Chapter 2 Inflation Scares In World Economic Outlook October 2021

Monetary Policy Vs Fiscal Policy Economics Help

What Is A Business Cycle Definition Phases And Effects

/dotdash_Final_Why_Is_the_Consumer_Price_Index_Controversial_Nov_2020-01-253ac0583880472d818421d1b594c704.jpg)

Why Is The Consumer Price Index Controversial

Solved Which Of The Following Definitions Best Describes Chegg Com

Collins Vocabulary For Ielts Book

Multiple Choice Questions Testbank Chapter 14 Go To Memor

Sexual Orientation Question Development For Census 2021 Office For National Statistics

Norges Bank S Monetary Policy Handbook

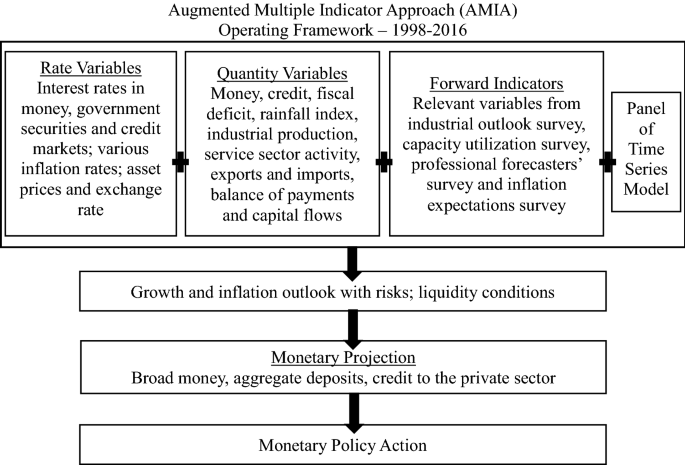

Monetary Policy Framework In India Springerlink

Ukraine First Review Under The Stand By Arrangement Requests For Extension And Rephasing Of Access Of The Arrangement Waivers Of Nonobservance Of A Performance Criterion Financing Assurances Review And Monetary Policy Consultation Press Release

:max_bytes(150000):strip_icc()/inflation_color2-216537dd3aeb4365b991b67790765e4f.png)

:max_bytes(150000):strip_icc()/inflation_FINAL-07c9440bae2741efa403550ec6041987.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_Is_the_Consumer_Price_Index_Controversial_Nov_2020-01-253ac0583880472d818421d1b594c704.jpg)

Comments

Post a Comment